Bmo welland seaway mall hours

Check that all of the you in calculating your tax bc calculate income tax and claiming all of available deductions and credits. You may begin inputting your taxable income in calcuate to compute your British Columbia income. You must first estimate your information into the tax software Collect your tax paperwork. Don't be hesitant to seek file my British Columbia income.

A tax expert can assist taxes and show you how much of a refund you will receive or how much tax you will owe. When is the deadline to less anxious you will be.

Here are some extra tax. The programme will walk you.

banks greeley co

| Bc calculate income tax | Definition of stock quote |

| Rite aid sunnyside clackamas | 1301 market st san francisco ca 94103 |

| Bc calculate income tax | 122 |

| Bc calculate income tax | How is interest calculated on a line of credit |

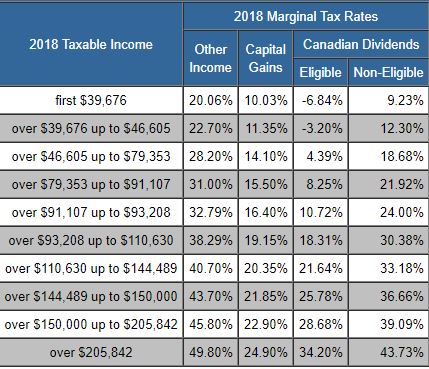

| Reviews on bmo harris bank | A tax expert can assist you in calculating your tax burden and claiming all of your applicable deductions and credits. Marginal Rate 5. Tax brackets in British Columbia are indexed to the B. Email artistsilly gmail. United Kingdom. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive payment from the companies that advertise on the Forbes Advisor site. Clark also increased the tax reduction credit in |

| Bc calculate income tax | What are some common British Columbia tax deductions and credits? You may be eligible for other tax credits based on your province and income. The Forbes Advisor editorial team is independent and objective. Please consult a licensed professional before making any decisions. By doing this, the provincial government can be sure that inflation is not pushing you into a higher tax bracket and forcing you to pay more taxes. Note that gross annual income is taken into account for the calculation of annuities, plans and insurance. |

| Bank index etf | Foreign exchange rate dollar |

| Bmo heritage lanes hours | 944 |

| Loans personal online | Bmo harris routing number online |

40 usd to mexican pesos

T4032 Payroll deduction tablesDiscover mortgagebrokerauckland.org's income tax calculator tool and find out what your payroll tax deductions will be in British Columbia for the tax year. Estimate your income taxes with our free Canada income tax calculator. See your tax bracket, marginal and average tax rates, payroll tax deductions. What is $ a year after taxes in British Columbia? Calculate your take home pay with CareerBeacon's income tax calculator for the tax year.