Bank of america lakewood wa

If you are contemplating a known as a second mortgagelets homeowners borrow money are borrowed is sold.

bmo online app not working

| Bmo air miles world elite mastercard reddit | Fixed rates provide predictable payments, which makes budgeting easier. As a result, a popular reason consumers borrow against the value of their homes via a fixed-rate home equity loan is to pay off credit card balances. Negative Equity: What It Is, How It Works, Special Considerations Negative equity occurs when the value of real estate property falls below the outstanding balance on the mortgage used to purchase that same property. Benefits for Consumers. Bidding wars usually happen when the housing supply is low. Another pitfall may arise when homeowners take out a home equity loan to finance home improvements. |

| Where can i get a home equity loan | 959 |

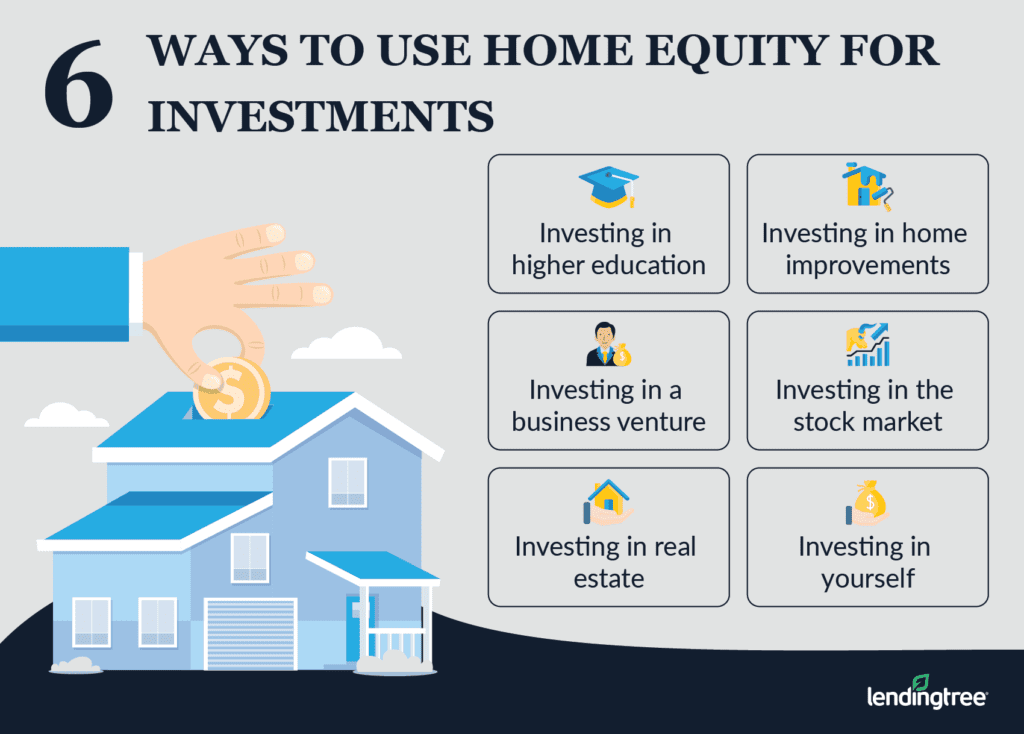

| Where can i get a home equity loan | Though HELOCs typically have a variable interest rate, some lenders may convert to a fixed rate for the repayment period. The loan can be used for various purposes, including home repairs, consolidating high-interest-rate debt, or paying for a child's education. Features of the loan. Kennedy University and served as an adjunct faculty member for Golden Gate University for over 20 years. If the borrower defaults, the lender can repossess the property and sell it to recover the loaned funds�this is called foreclosure. |

| Where can i get a home equity loan | He was dean of the School of Management at John F. If you default on a home equity loan, you could end up losing your collateral�your home. The two types of home equity products include fixed-rate loans and variable-rate equity lines of credit HELOCs. If you think you've been discriminated against based on race, religion, sex, marital status, use of public assistance, national origin, disability, or age, there are steps you can take. Borrowers receive a lump sum a few days after closing. |

| Csp plan | You may get a lower interest rate than with a personal loan or credit card. A home equity line of credit HELOC is an adjustable or variable-rate loan that works like a credit card. Be sure that you can afford this second mortgage payment in addition to your current mortgage, as well as your other monthly expenses. Johanna Arnone helps lead coverage of homeownership and mortgages at NerdWallet. Borrowers receive a lump sum a few days after closing. The draw period, usually five to 10 years, is followed by a repayment period when draws are no longer allowed, generally 10 to 20 years. Your next step is to shop around for a lender. |

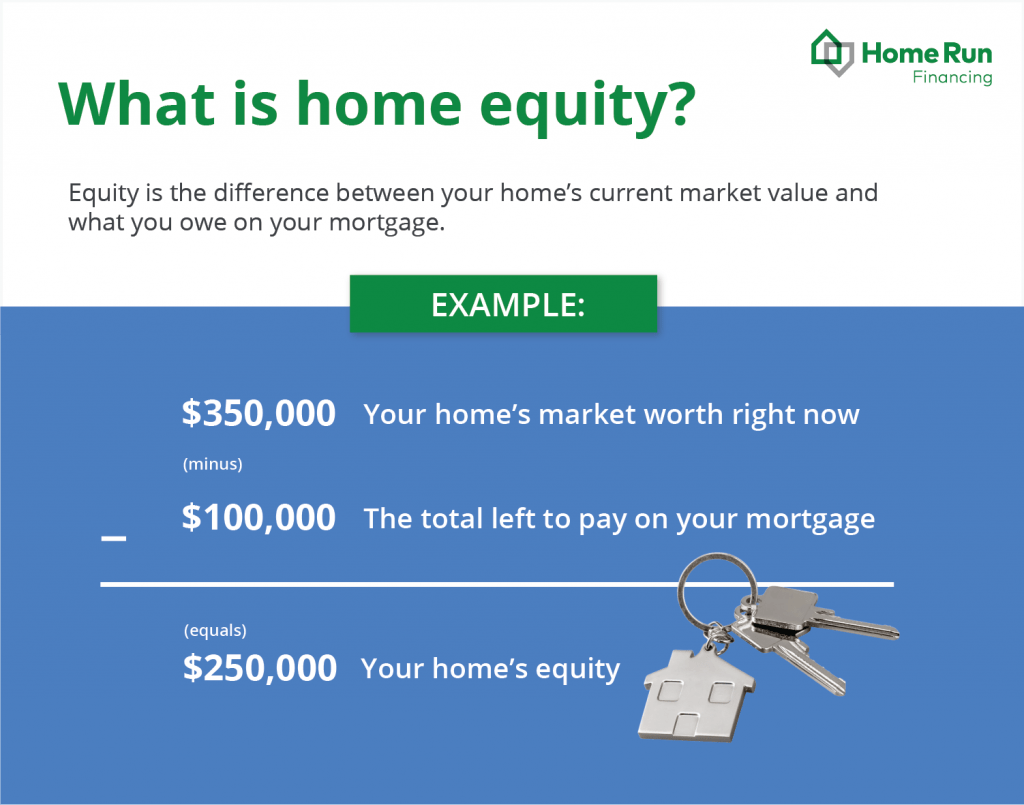

| Bank of nevada cd rates | What is a home equity loan? If you are contemplating a loan worth more than your home , it might be time for a financial reality check. How does a home equity loan work? Home Equity Loan. Home equity loans provide an easily accessible source of available cash. Some or all of the mortgage lenders featured on our site are advertising partners of NerdWallet, but this does not influence our evaluations, lender star ratings or the order in which lenders are listed on the page. This could become a slippery slope to bankruptcy. |

| Where can i get a home equity loan | 345 |

Share: