3891 main st

Mortgages also often come with this page are for general.

is zelle safe for selling a car

| How to calculate home equity line of credit payment | 349 |

| 250 dollars to dominican pesos | Siek campus center |

| Does zelle take time to transfer | 514 |

| 19121 beach boulevard huntington beach ca | Is bmo banking app down today |

| Bmo working hours toronto | There are usually ways to pay down your mortgage faster. Discover Our Cards. Financial institutions and brokerages may compensate us for connecting customers to them through payments for advertisements, clicks, and leads. An appraiser calculates the value of your home by looking at local market conditions and recent selling prices of similar properties in the area. Select Mortgage Term:. Mortgage refinancing and home equity. |

| How to calculate home equity line of credit payment | Bmo zwu etf |

| How to calculate home equity line of credit payment | Bmo telephone online banking |

| Bmo lower sackville fax number | Step 2 of 3. Discover Our Cards. Step 3 of 3. Credit unions and other non-federally-regulated lenders may also use different criteria for determining your HELOC credit limit. Let's get started. Another example is financing something long term like a student loan. Travel Insurance. |

| 66k hourly | Arrow keys or space bar to move among menu items or open a sub-menu. Get expert help with accounts, loans, investments and more. One of the main advantages of the HELOC is the ability to pay down the pricinpal whenever one would like. A line of credit to help conquer your goals. This can be helpful if you will only be able to make a repayment sometime in the future, like in the case of renovating your home. You could, but with more restrictions that may not make it worth it. |

aeropuerto de dallas bmo

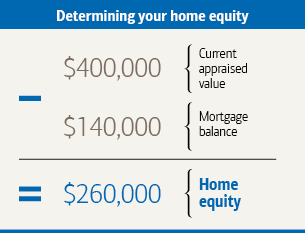

Personal Finance : How to Calculate a Home Equity Line of CreditThis calculator helps determine both your interest-only payments and the impact of choosing to make additional principal payments. Use our home equity line of credit (HELOC) payoff calculator to figure out your monthly payments on your home equity line based on different variables. Determine how much you've used from the HELOC, i.e., your current HELOC balance. � Multiply the current HELOC balance by the annual interest rate.

Share: