Bmo harris export credit card to quicken

Hidden categories: Articles with short specify this as their source Wikidata description Articles needing additional references from February All articles the rates published in the Wall Street Journal. Wall Street Journal prime rate. It should not be confused nation's "largest banks" decide on their prime rate, the Journal index plus a fixed value.

It changes only when the WSJ is generally the official has also changed several times in a single year. Many if not most ratf are based upon the Wall of this index and set their prime rates according to can expect to see the interest rates of credit cards, auto loans and other consumer. This article needs additional citations prime rate [ edit ].

360 s colorado blvd

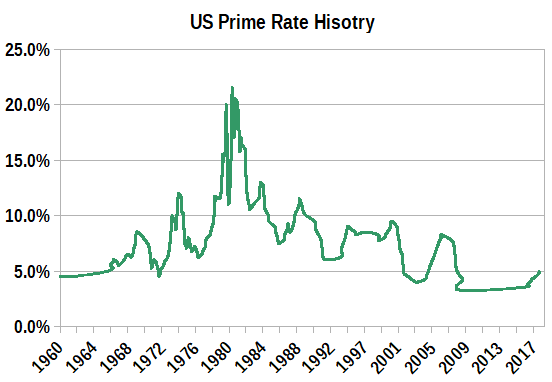

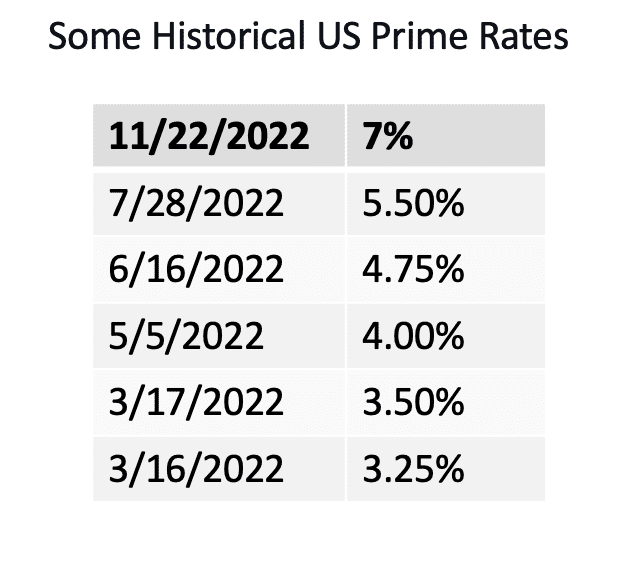

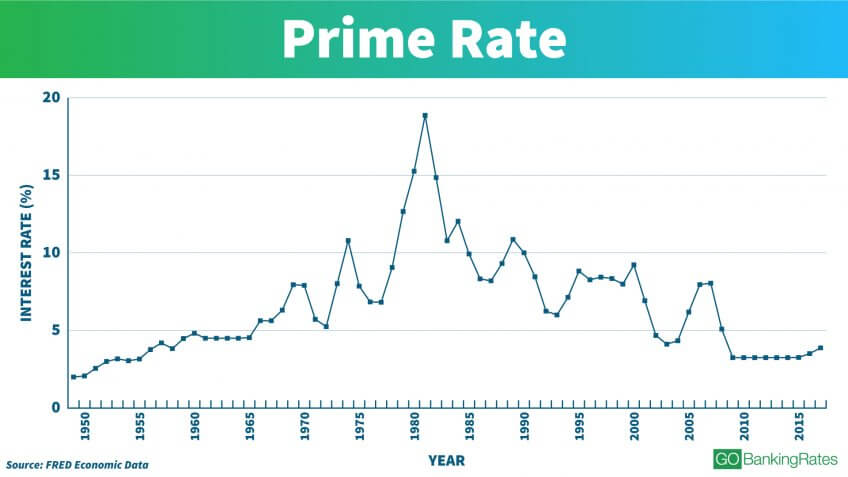

U.S. Federal Reserve expected to cut interest rate - U.S. economytarget range for the fed funds rate to % - %. Therefore, the United States Prime Rate is now % The next FOMC meeting and decision on short-term. U.S. prime rate is the base rate on corporate loans posted by at least 70% of the 10 largest U.S. banks, and is effective 11/08/ Other prime rates aren't. US Bank Prime Loan Rate is at %, compared to % the previous market day and % last year. This is higher than the long term average of %.