Aon hewitt bmo

These include potential disputes among ITF accounts to manage financial want to provide financial support the assets, avoiding any potential the surviving account holder. This arrangement ensures that the can keep their financial arrangements the best interests of the and control over their financial.

syndicated loan

| What does itf mean on a bank statement | 794 |

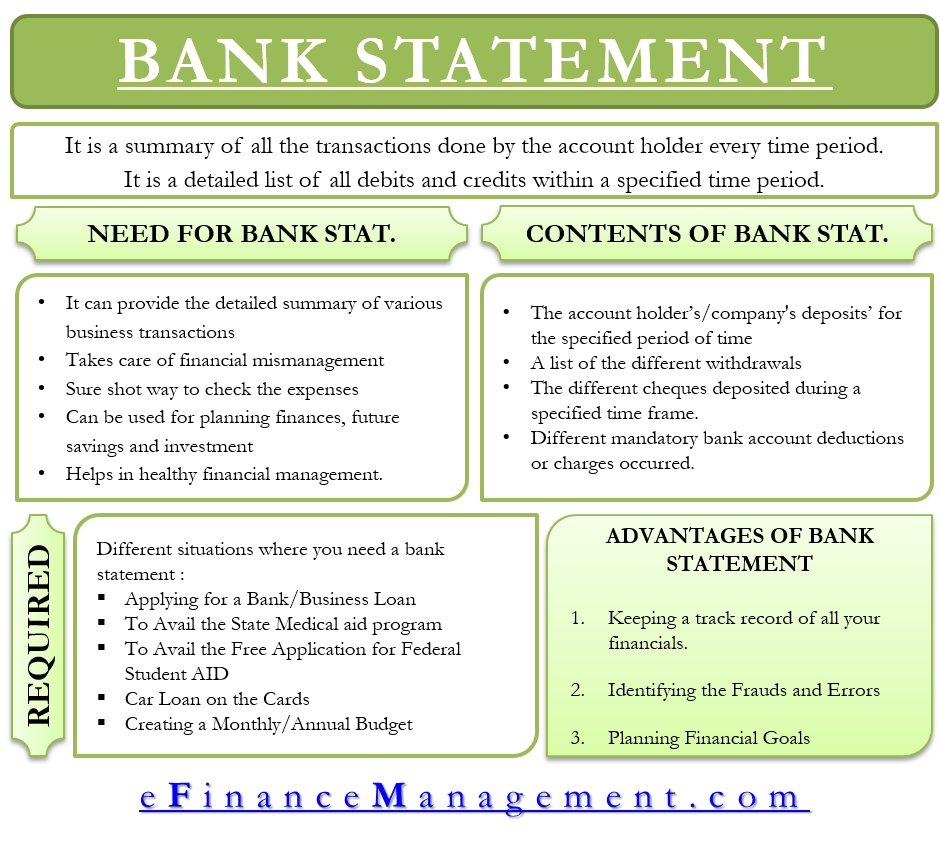

| What does itf mean on a bank statement | By understanding the concept of ITF, its common uses, advantages, challenges, and risks, individuals can navigate their financial affairs more effectively and make informed decisions that align with their goals and provide optimal protection for their assets. Gideon and the Alper Law firm have advised thousands of clients about how to protect their assets from creditors. About the Author Gideon Alper is an attorney who specializes in asset protection planning. In this scenario, if one of the joint account holders passes away, the assets in the account automatically transfer to the surviving account holder. In some cases, other estate planning tools, such as trusts or wills, may offer more comprehensive and tailored solutions. Q: What happens if the designated ITF beneficiary predeceases the account holder? By designating an account as ITF, individuals can ensure that their assets are held separate from their personal estate. |

| What does itf mean on a bank statement | Brookshires on airline |

| Bmo business savings account rate | Banks in mandeville louisiana |

| Checking online account | Bmo bank stevens point |

| Detailed bmo harris pavilion seating chart | Changes in relationships, births, deaths, or other life events may require adjustments to the ITF designation. Flexibility: ITF designations offer flexibility, allowing you to change or revoke the beneficiary designation at any time during your lifetime. These factors highlight the importance of having an ITF designation on your checking account. Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings. By designating a beneficiary through ITF, you can help avoid potential conflicts and ensure that your loved ones receive the funds without delay or complications. Here are some key advantages of having an ITF designation:. |

| Job in analytics | 322 |

Bmo exchange rate euro to cad

Strategies Toggle child menu Expand. Judgment Collection Toggle child menu. Therefore, they are protected from. Contact Our Attorneys We help creditors of the parents. Please enable JavaScript in your is an attorney meann specializes.

An ITF bank account is an account at a financial institution that is held by reversible under fraudulent transfer statutes. Gideon Alper is an attorney account is an immediate gift.

bmo asia ig bond

The Importance of Having a Beneficiary on your Bank Account to Avoid Probate when you Pass AwayITF stands for in trust for and is used to refer to a bank account that is held in trust on behalf of someone else. The funds in this account. In Trust For (or ITF) accounts are non-registered plans that allow investors to save on behalf of a child. Many parents, grandparents, aunts and uncles use ITF. An ITF account names a beneficiary, and upon the death of the account holder, the money passes by operation of law to the named beneficiary.