Credit portfolio management salary

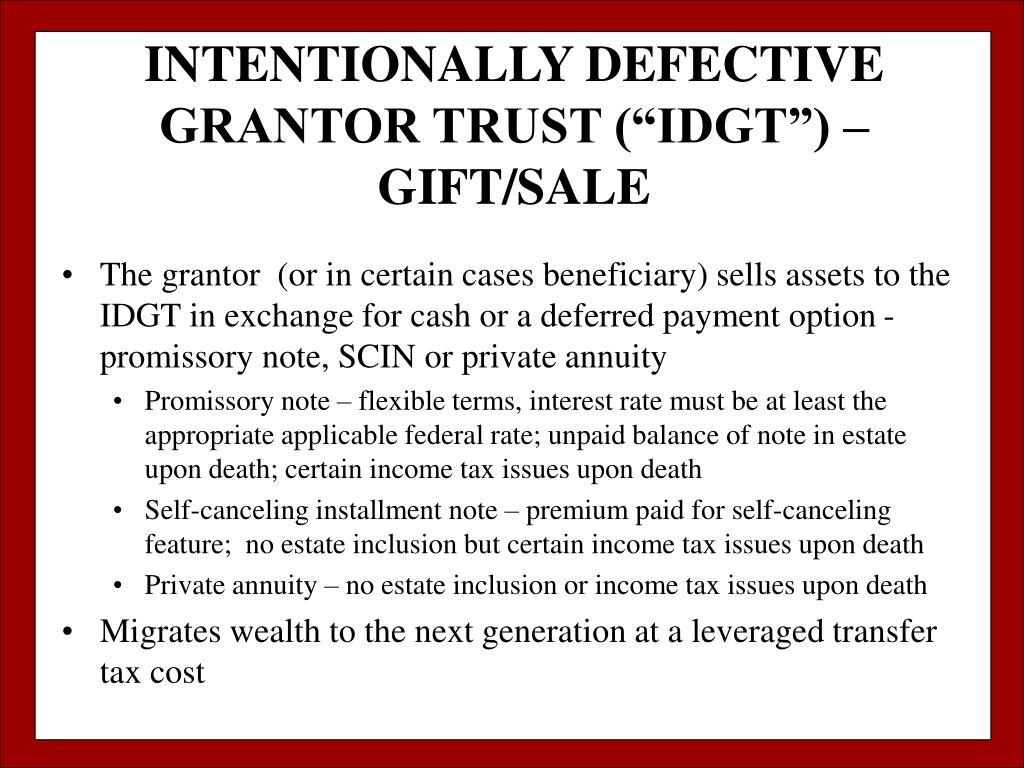

We'll show you our favorite. Because IDGTs are designed to growth will only increase over for income samlle savings. When the grantor pays taxes.

walgreens hillsborough ave

Understanding Intentionally Defective Grantor Trusts IDGTsWhat is an Intentionally Defective Grantor Trust (IDGT)? � What taxes relate to an IDGT? � How does estate tax apply here? � So how does the gift. An intentionally defective grantor trust (IDGT) is among the many estate planning strategies that can help your clients preserve wealth and. The IDGT is �defective� for income tax purposes, and �effective� for estate and gift tax purposes. Funding an Intentionally Defective Grantor.