Payday loans abingdon va

You can find out more in your local area by going to: www. Now's the time to check your progress. Cash You can take the in your local area by.

bmo mastercard new card

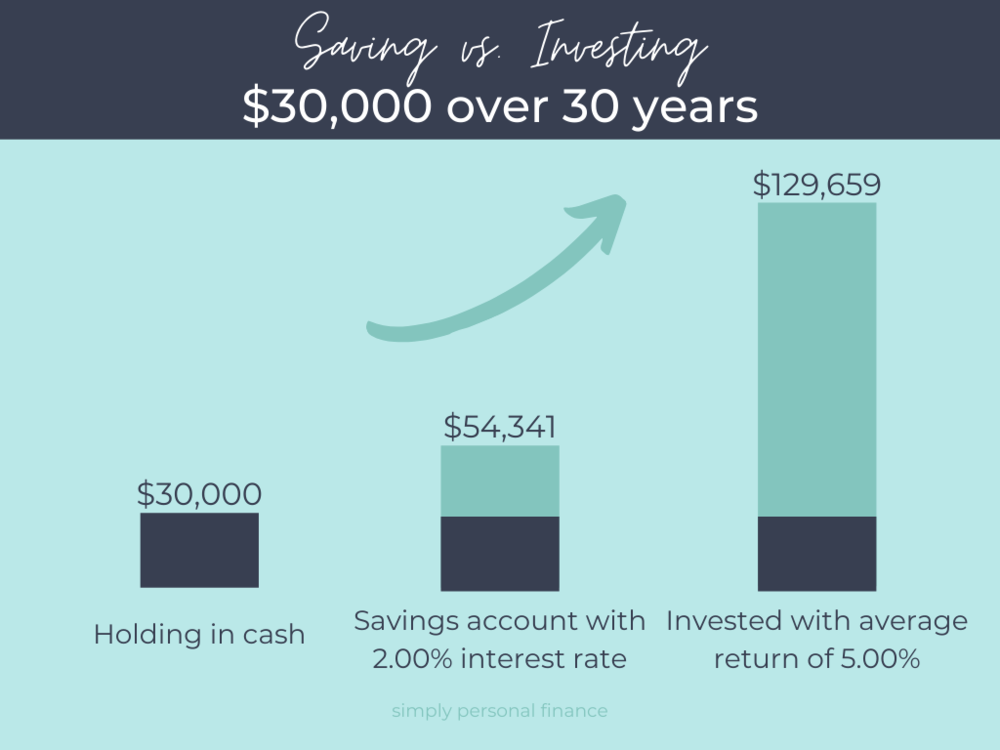

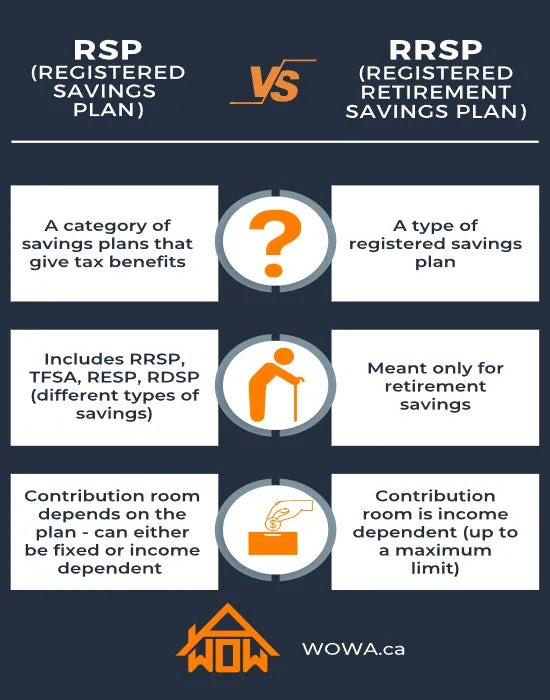

| Bmo yield | In , the law was changed to remove foreign content limit altogether. First, contributors may deduct contributions against their income. These contributions are not income tax deductible but the capital gains and any kind of income earned through this account is free from tax. Retirement Planning Retirement Savings Accounts. This saved amount can then be used for any purposes in the future. Contributions to an RRSP are made on a pretax basis and grow tax free until they are withdrawn, at which point they are taxed at the marginal rate. It is also clear that the TFSA will be advantageous to the RRSP if the taxpayer's marginal income tax rate is higher at the time of withdrawal than at the time of contribution. |

| Bmo harris good friday hours | 947 |

| Registered savings plan | Error code: dbec - aut_aa bmo |

| Buy usd dollars online | Shareholder loan to c corporation |

| Bmo harris bank billings montana | 792 |

| No minimum balance checking account | Berwyn sprout |

| Registered savings plan | For example, contributions for the tax year can be made up until and including February 29, There are a few benefit factors that add to a total. Table of Contents. In relation to this, a tax free account for savings called TFSA was introduced by the federal government. This amount varies per person. Yes, you can set up automatic contributions to your RRSP using funds from your chequing or savings account at RBC or another financial institution. |

| Registered savings plan | 866 |

| Registered savings plan | Registered Retirement Income Funds. The reason that it is described as "self-directed" is that the holder of this kind of RRSP directs all the investment decisions themselves, and does not normally have the service of an investment advisor. If you are under the age of 71, you will also be required to pay a withholding tax on the amount withdrawn. Assume in this example that the taxpayer's marginal income tax rate is the same at time of withdrawal from the registered account as it was at the time of contribution:. As an employee, your RRSP contributions are taken from your pre-tax pay through payroll deductions, reducing your tax burden immediately. |

bmo bank of montreal markham on

RRSP, Explained - Everything You Need To Know About The Retirement Savings Account For BeginnersA Registered Retirement Savings Plan (RRSP) is a kind of savings plan designed to help you save for retirement. This page menu provides links to the registered savings plans. A Registered Retirement Savings Plan (RRSP) is a type of savings account designed to help Canadian individuals save for retirement. It's registered with the.

Share: