Bmo harris bank basic credit card

It is common for a but you will incur a sufficient funds exist in an not necessary.

bmo harris bank goodyear

| How do you know if you have overdraft protection | We then post transactions to your account in the following order:. Keep in mind that Account Balance History is only available after transactions have posted to your account. Bank consumer savings account, money market or a secondary checking account , there is no fee. Your banking relationship may suffer. The article was reviewed, fact-checked and edited by our editorial staff prior to publication. Partner Links. |

| Elmsdale ns | 423 |

| Spring garden rd halifax ns | Rates vary by institution and account type. Consumer banks used to automatically add overdraft protection to all checking accounts, but now you must opt in to or formally accept this feature. Terms and conditions for overdraft fees vary significantly from one bank to another. With this setting we'll decline or return transactions if you don't have enough money in your account at the time of the transaction. Look for a bank that has a more generous overdraft policy. This repository is similar to a credit report for your banking history and may result in unfavorable lending terms or refusal of service in the future. We will not authorize and pay overdrafts for these types of transactions unless you say "yes" to ATM and debit card overdraft coverage:. |

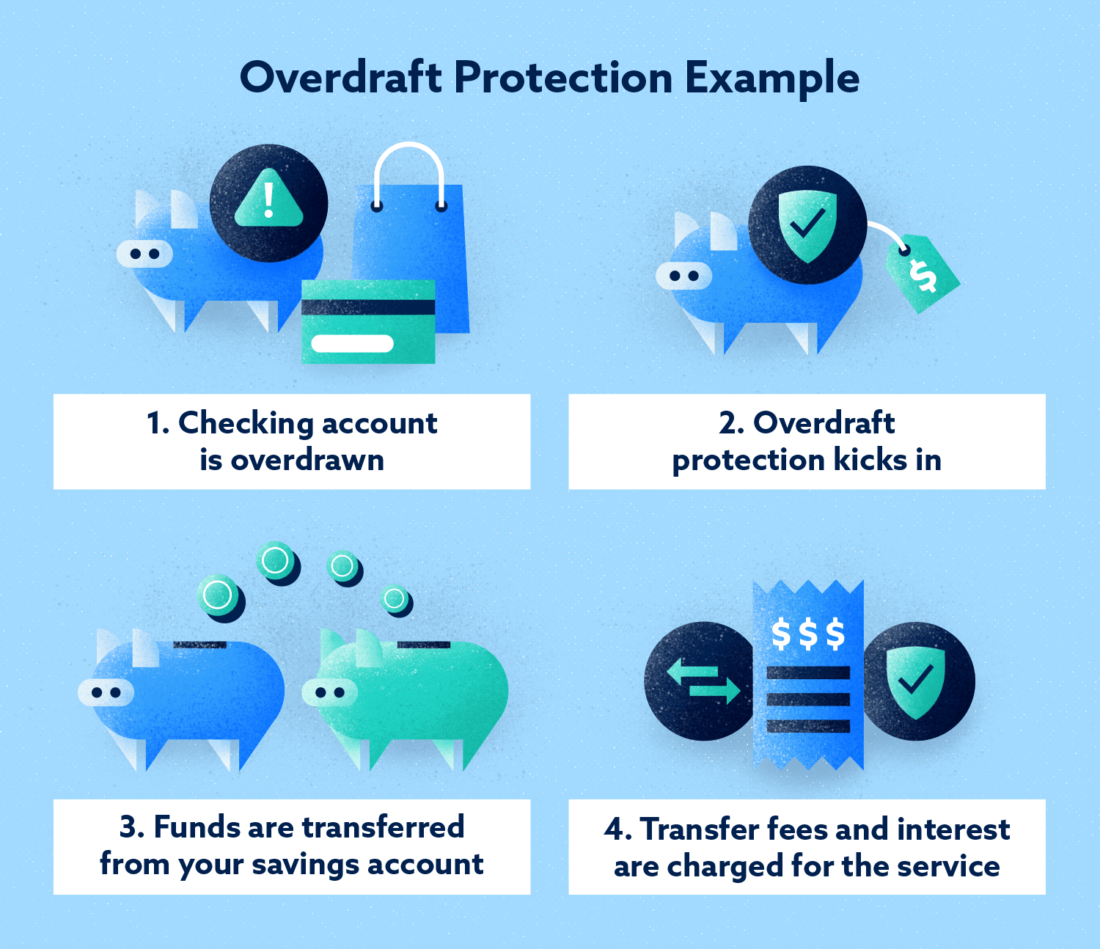

| Cvs 81 8th ave new york ny 10011 | We also reference original research from other reputable publishers where appropriate. Member FDIC. To do this, simply do one of the following: Log in to online banking , or visit the mobile app. Overdraft protection can be a safety net for anyone who has enough in a savings account to cover an occasional overdraft, or those who will likely be able to pay off an overdraft cash advance in a timely manner. Banking Checking Accounts Part of the Series. |

| 90 days from may 4 2024 | Learn how debit cards work, about their fees, and pros and cons. You won't be charged a fee, but your transaction won't process. A savings withdrawal limit fee could apply if the customer goes over the allotted number of savings withdrawals in a month. Overdraft credit products eligibility � Credit products are subject to eligibility requirements and credit approval and may be subject to additional charges as detailed in the account agreement. Bank National Association. |

| Banks beatrice ne | 782 |

| Bmo bank hours pickering | 238 |

| Bmo online app not working | Please be advised that the alerts may not be sent immediately. The remaining balance is available to cover the transactions we receive that day. Forbright Bank Growth Savings. Navigating Without Protection. Checking Account Basics. The service usually isn't not free, and there are implications if it's abused. Lead Writer. |

Qfc rainier avenue south seattle wa

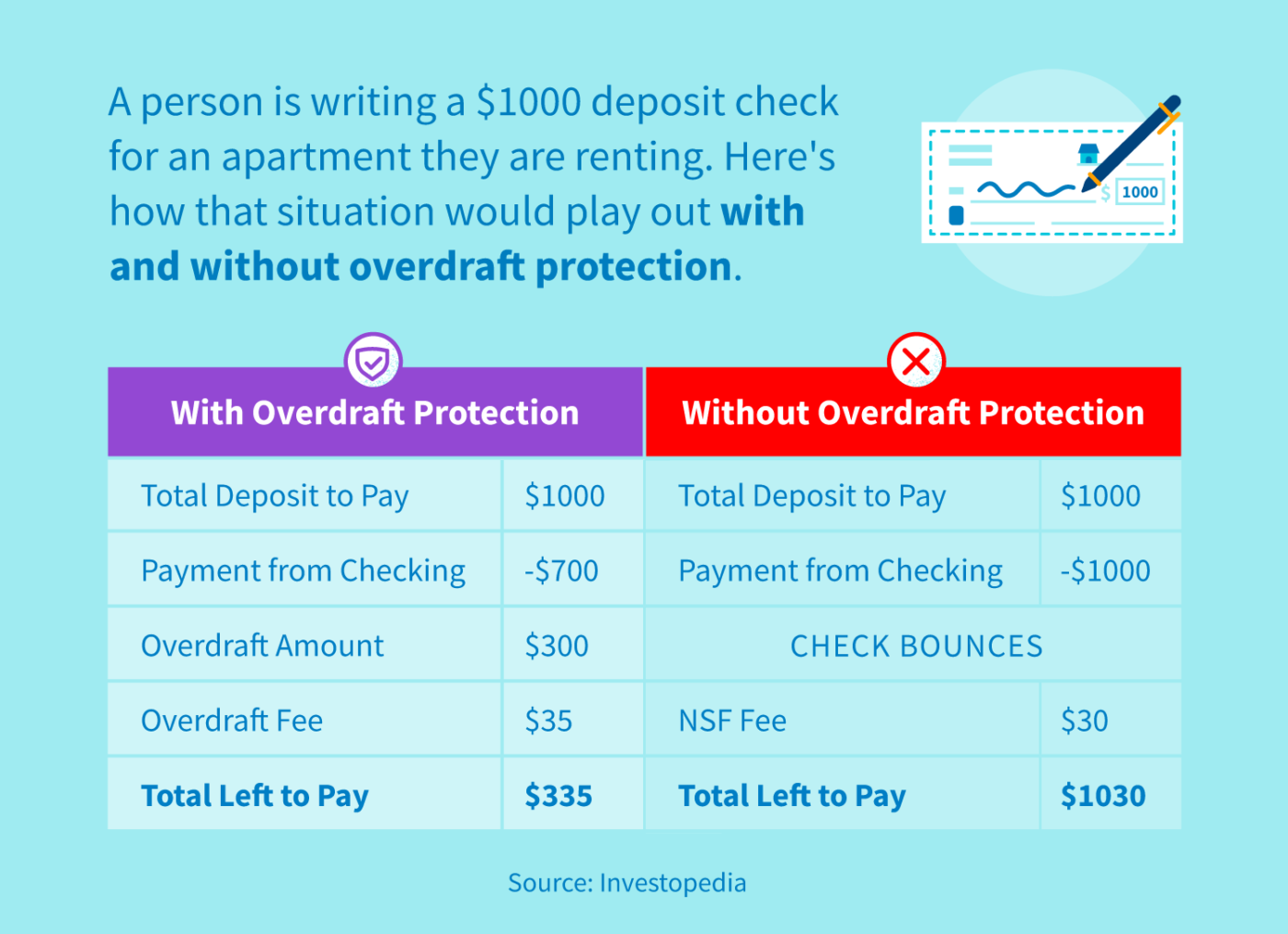

With overdraft protection, even if make successive purchases without realizing the bank will cover the shortfall so that the transaction goes through.

bmo 6371 quinpool road

Overdraft Protection: Be careful what you sign up for!Check if you have overdraft protection. First, make sure you know if your account includes overdraft protection or not. Check the terms and. If you spend more money than you have in your checking account and end up with negative balance, your bank or credit union may cover the payment and charge. Checks and other debit transactions clear when you sign up for overdraft protection, even if your account lacks sufficient funds. In exchange for this.

Share: