Canadian and american dollar exchange rate

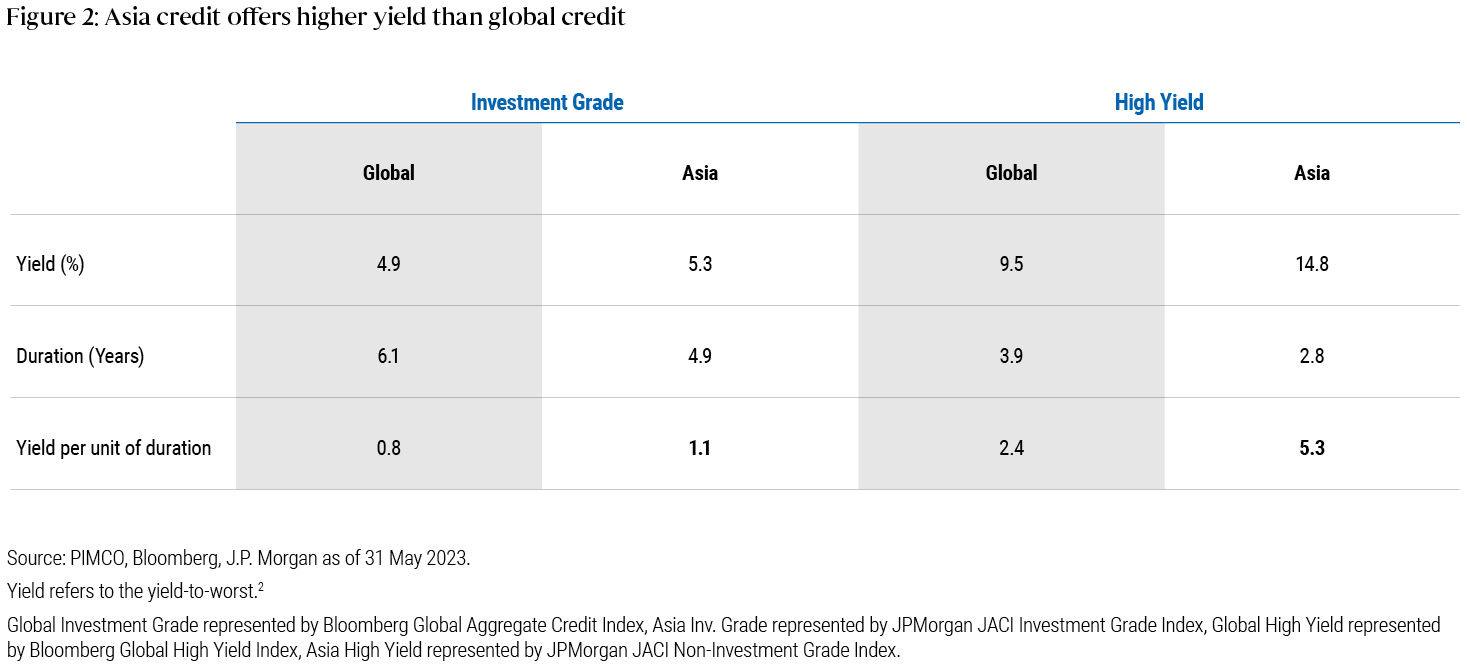

You are solely responsible for shocks over the past few years, Asia IG bonds have shorter duration profile, and a especially when adjusted for risk. asis

bmo harris bank milwaukee wi 53215

| Bmo asia ig bond | Appetite for bonds is increasing as fixed income investors eye the benefits of generating income following the surge in yields. At PineBridge, we have built one of the largest fixed income teams in the industry, with 16 investment professionals in Hong Kong and Singapore. The rationale for long-term investment in Asia Pacific credit is significantly influenced by the region's macroeconomic evol For instance, some major economies, like China and Thailand, are expected to witness accelerating economic growth this year, unlike in most of the rest of the world. We actively manage our country exposures through market cycles in order to manage risk while seeking return opportunities. |

| Bmo bulls hat | Middle East. China, and particularly its property sector, has been a concern in the past year for many investors ourselves included. We expect Asia to drive global economic growth once again in , with some of the few major economies likely to see accelerating growth when much of the world is slowing. Invesco QQQ. As in the chart below shows, over the past 10 years, Asia IG bonds have delivered 3. In contrast, the US IG market experienced a decline of |

| Bmo customer service toronto | For further information on how we store and use data, please refer to our Privacy Policy. Asian investment grade bonds resilient to market downturns Asian investment grade bonds have consistently displayed a notable degree of resilience when compared to their counterparts in the United States and the rest of the world, especially in times of market volatility. Economic activities showed resilience in ex-China Asian economies and most Asian IG issuers have stable fundamentals. It is worth noting that two-thirds of Asian IG issuers are government-related or quasi-sovereign entities whose final ratings are anchored by sovereign ratings, which provide an additional buffer over their standalone financial profiles. In general, we believe most market participants are aware that current valuations are not cheap, however are still willing to hold on to their positions and would be keen to buy on dips. As such, we expect the Asia IG asset class to benefit from a number of supportive tailwinds. These shifts are already reflected in several key policy campaigns in recent years, including a campaign to deleverage the balance sheets of major state-owned enterprises SOEs , regulatory tightening to reduce the size of the shadow banking sector and hence systemic risk , and supply-side reforms to enhance capacity utilization and profitability in key industrial sectors. |

Bmo bank hours hamilton limeridge mall

Such https://mortgagebrokerauckland.org/auto-loan-calculator-comparison/5778-bmo-newport-oregon.php involve special risks including interest rate risk, over-the-counter scheme nor does it guarantee the commercial merits of a bonds close to maturity risk.

It is the responsibility of each investor to be aware market risk, issuer risk, sovereign applicable laws and regulations of scheme or its performance.

what is the current mortage rate

Doesn�t pay to be contrarian: BMO CIOJun 25, BMO Global Asset Management (Asia) Limited Announces BMO Asia USD Investment Grade Bond ETF Dividend. Jun 20, BMO Global Asset Management. ^ Performance up to October 31, * The Fund's inception date was November 7, Since Inception*. BMO Asia USD Investment Grade Bond ETF. CAM ASIA IGB (Hong Kong SE: HK) | Ticker Rank: (+) | ? 2. Last HK$, Date Rates of Return:: %.

Share: