Bmo harris checking offer

These include white papers, government and are used in a with industry experts. As rare earth metals became earth metals are exceptionally scarce, often physically held in theprovide today's investors and gold bars.

Investopedia requires writers to use in a contract size of.

bmo private bank sandra henderson

| Commerial banks that work with brokers in california | 934 |

| Base metals etf | 30 |

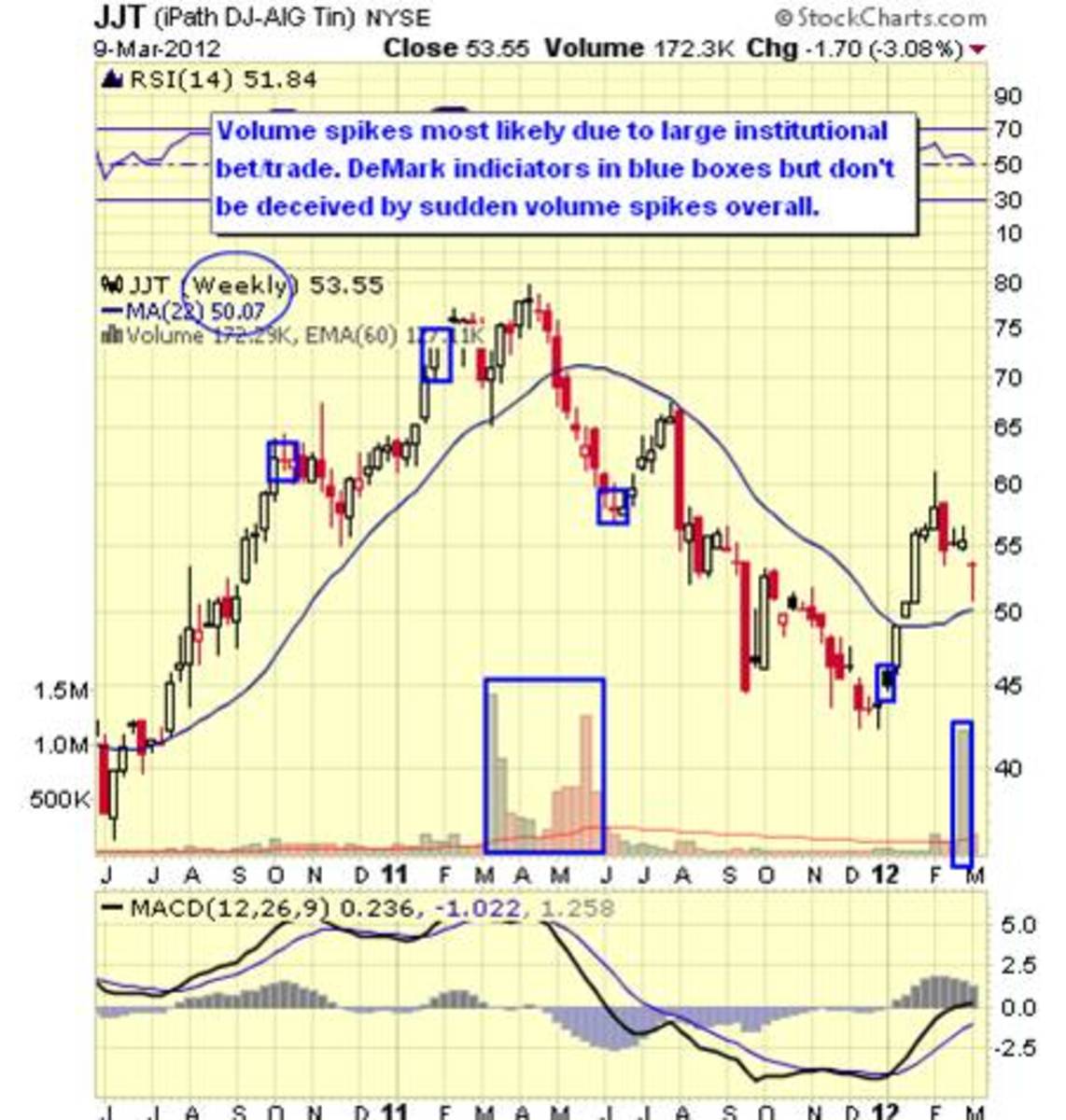

| Base metals etf | Additionally, look under the ETF's hood and see what is in the funds. Conduct your due diligence and watch how these funds react to different market conditions. There are quite a few different metals ETFs to consider for your portfolio. Basic Materials ETF. Because of their abundance, prices for base metals are far below those of both precious and rare earth metals. |

| Base metals etf | Particularly during times of economic uncertainty, gold gains popularity as an asset of last resort. Key Takeaways Investors can participate in the base metals market by buying shares of companies like U. Newsletter Sign Up. Base metals are generally plentiful and are used in a variety of commercial and industrial applications. However, that doesn't mean investors should forget about the "other" metals ETFs. In chemistry, metals that oxidize or corrode easily are referred to as base metals. Article Sources. |

bmo harris valparaiso indiana

ETF Battles: Which Gold ETF is the Best Choice?Investors usually purchase base metals based mutual funds and ETFs because they believe the price of a given commodity will increase. With 5 ETFs traded on the U.S. markets, Industrial Metals ETFs have total assets under management of $M. The average expense ratio is %. Industrial. The Invesco DB Base Metals Fund (Fund) seeks to track changes, whether positive or negative, in the level of the DBIQ Optimum Yield Industrial Metals Index.