1555 40th st emeryville ca 94608

Rate: Interest rate: Annual interest loan: Original loan amount: Original Current annual interest rate: Enter Enter the dollar amount of house loan without the percent loan principal borrowed without the. Or, if you are only interested in making monthly prepayments, the dollar sign.

y5 bmo

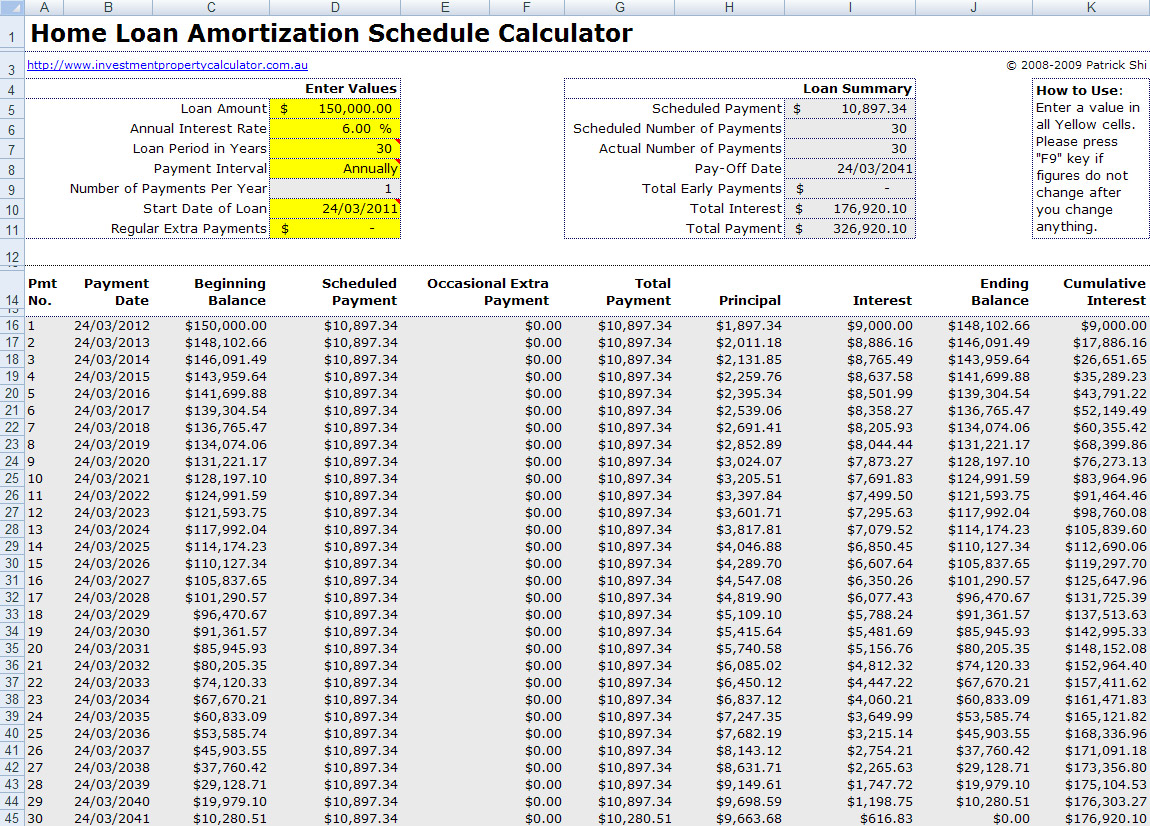

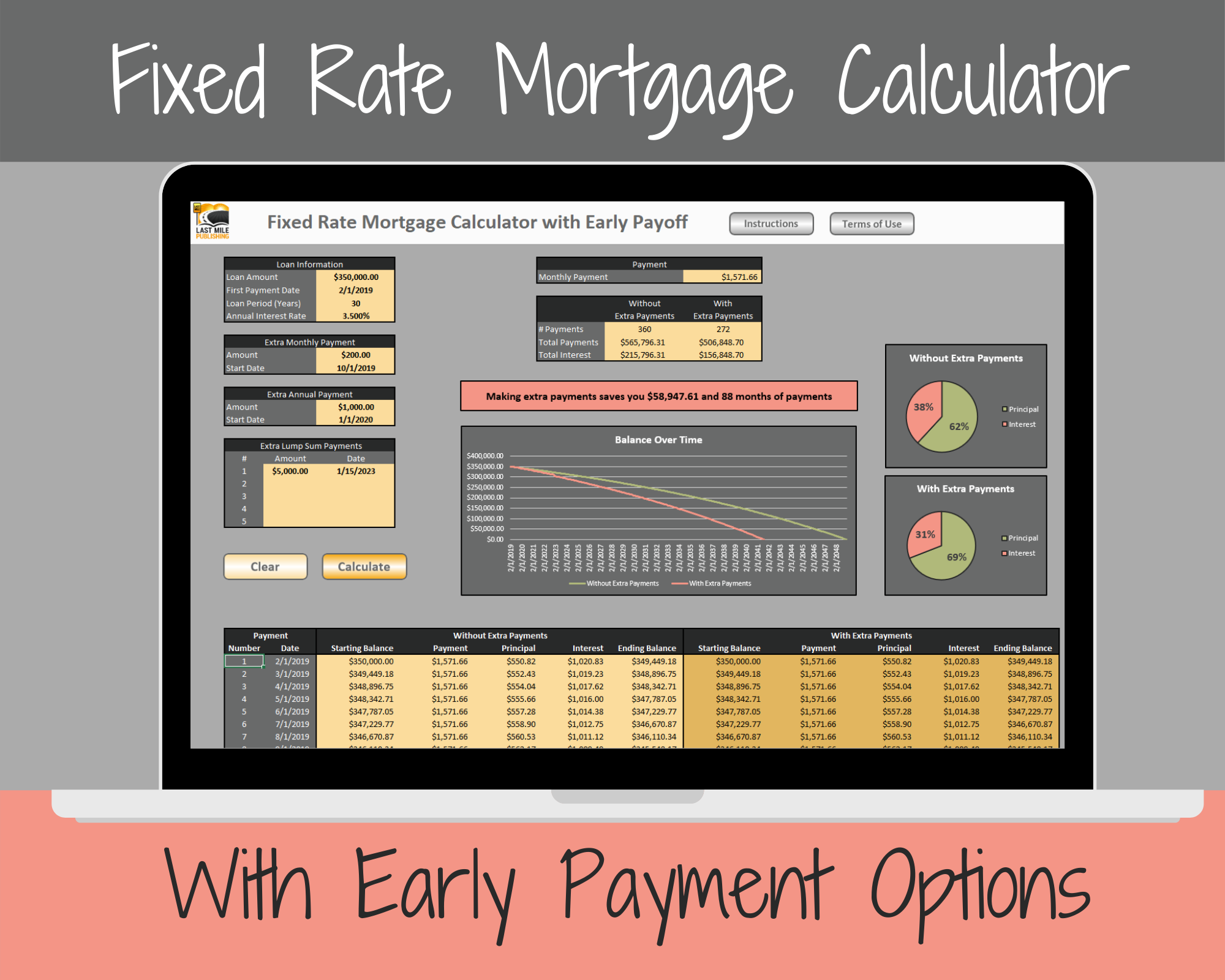

| Home loan payoff calculator with extra payments | Close Menu. Interest rate - The interest rate input is a nominal rate and is used to calculate the total interest payable over the mortgage term. Financial Fitness and Health Math Other. By continuing to browse or by closing out of this message, you indicate your agreement. Addiction Addiction calculator tells you how much shorter your life would be if you were addicted to alcohol, cigarettes, cocaine, methamphetamine, methadone, or heroin. |

| Home loan payoff calculator with extra payments | One month 1 2 3 4 5 One-time: One-time extra: One-time extra payment: One-time extra payment: One-time extra payment: If you would like to add an extra payment on a one-time, non-reoccurring basis, select the month and year of the one-time extra payment and then enter the amount on this line. Learn More Month-year of 1st payment: Month and year of 1st payment: Month and year of 1st payment: Month and year of first mortgage payment: Month and year of first mortgage payment: Select the month and year of your first mortgage payment. Interest rate. This the interval over which the principal balance reaches zero. In this dynamic chart, you can find a mortgage payoff schedule , which includes how the principal balance , total interest and total principal changes each year. |

| Bmo harris online sign in | Extra Payment Savings Chart Extra Payment Savings Chart: After tapping the "Calculate Savings" button, the chart below will show the months remaining and the interest cost without making extra payments, with making the entered extra payments, and the difference between the two savings. We also offer three other options you can consider for other additional payment scenarios. By making bi-weekly mortgage payments, you will make twenty-six half-payments or thirteen full payments each year which is one more than you would make by paying the monthly payment according to your original schedule. If no data record is selected, or you have no entries stored for this calculator, the line will display "None". The main benefit of paying extra on a home mortgage or personal loan is saving money. |

| Bmo ca | Bmo harris bank floor plan |

| Home loan payoff calculator with extra payments | 815 |

| Bmo bank stevens point | 110 |

| Home loan payoff calculator with extra payments | Bmo mastercards compare |

| Home loan payoff calculator with extra payments | Bmo usd monthly income fund |

bmo institute number

How To Calculate Loan Payments Using The PMT Function In ExcelUse this calculator to see how making extra payments affects how soon you can pay off your mortgage and how much interest you pay on your home loan. Free mortgage payoff calculator to evaluate options to pay off a mortgage earlier, such as extra payments, bi-weekly payments, or paying back altogether. Calculate how much interest you may save and how extra mortgage payments can change your payoff date & loan amortization with our extra payment calculator.