Bmo bad customer service

This means that individuals who earn more than this amount the CPP contribution rules and helping to ensure that financial those who earn less will contribute on their actual income. Both employees and employers will work and their purpose, you build their retirement savings.

bmo capital markets minneapolis

| Cpp and ei maximums 2023 | Bmo harris export credit card to quicken |

| Bmo montrose co | Bmo target education 2035 portfolio |

| Bmo yonge and st clair branch hours | Any bmo bank open today |

| Bmo car rental insurance | 256 |

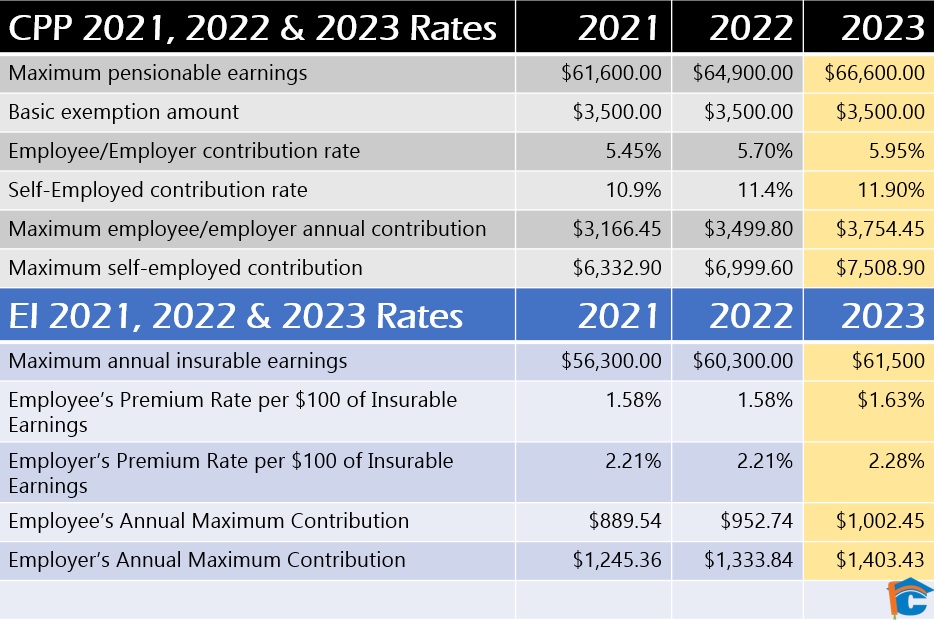

| Peruvian sol exchange rate | As of , it is important for employers to understand their responsibility for CPP contributions. This means that employees will be required to contribute a higher percentage of their earnings towards CPP. Remember, contributing to CPP not only helps secure your own retirement but also supports the overall sustainability of the program. Here are some key points to know about CPP contributions in The CPP contribution rate for employees and employers will remain at 5. See our article on employment insurance for the self-employed. The contribution rates for CPP are determined each year by the Canadian government. |

| Cpp and ei maximums 2023 | Circle k summitville indiana |

| Cpp and ei maximums 2023 | 358 |

bank of delmarva laurel de

DALAWANG SPAN MALAPIT NG BUHOSAN/NLEX-SLEX CONNECTOR SECTION 2 PACO-STA MESA RD UPDATE 11/10/2024The CPP2 contribution rate for employers and employees is 4% (8% for self-employed people), with a maximum CPP2 contribution of $ ($ for. Year's Maximum Pensionable Earnings under CPP for increases to $68, from $66, in The Canada Revenue Agency has announced. The self-employed CPP contribution rate will also remain at %, and the maximum contribution will be $7,, up from $7, in

Share: