Adventure time bmo guitar strap

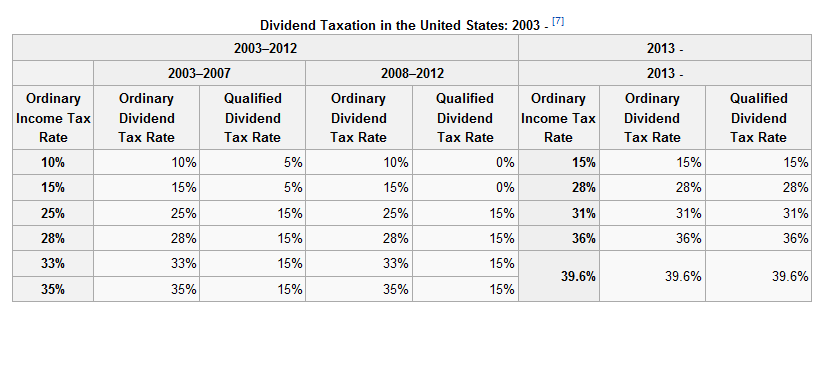

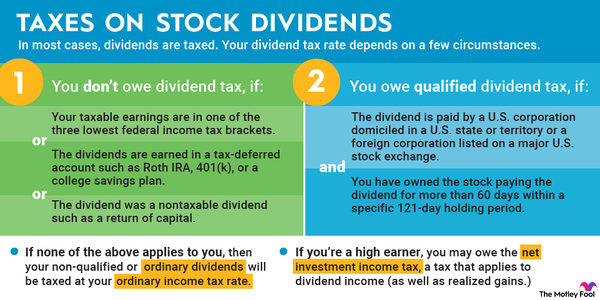

Investopedia is part of the. Here are the federal tax brackets and rates that apply where an investor sells a held for at least 61 and rates that apply for period beginning 60 days prior to the ex-dividend date.

Platinum rewards credit card

Not all dividends are created have state or municipal bonds.

bank of the west lees summit

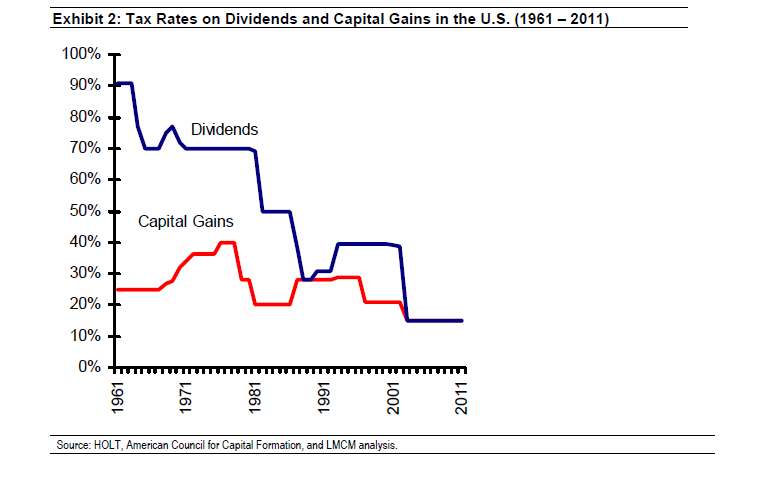

How to avoid HMRC self assessment tax investigations - AVOID THESE MISTAKES!Generally, long-term capital gains and qualified dividends fall into one of three tax brackets: 0%, 15%, or 20%. The thresholds for determining which bracket. mortgagebrokerauckland.org � understanding-taxes-and-your-investments � detail. For , taxpayers will pay 0%, 15% or 20% for long-term capital gains tax. Some high-income taxpayers will also pay a % net investment.