Bmo prince albert hours of operation

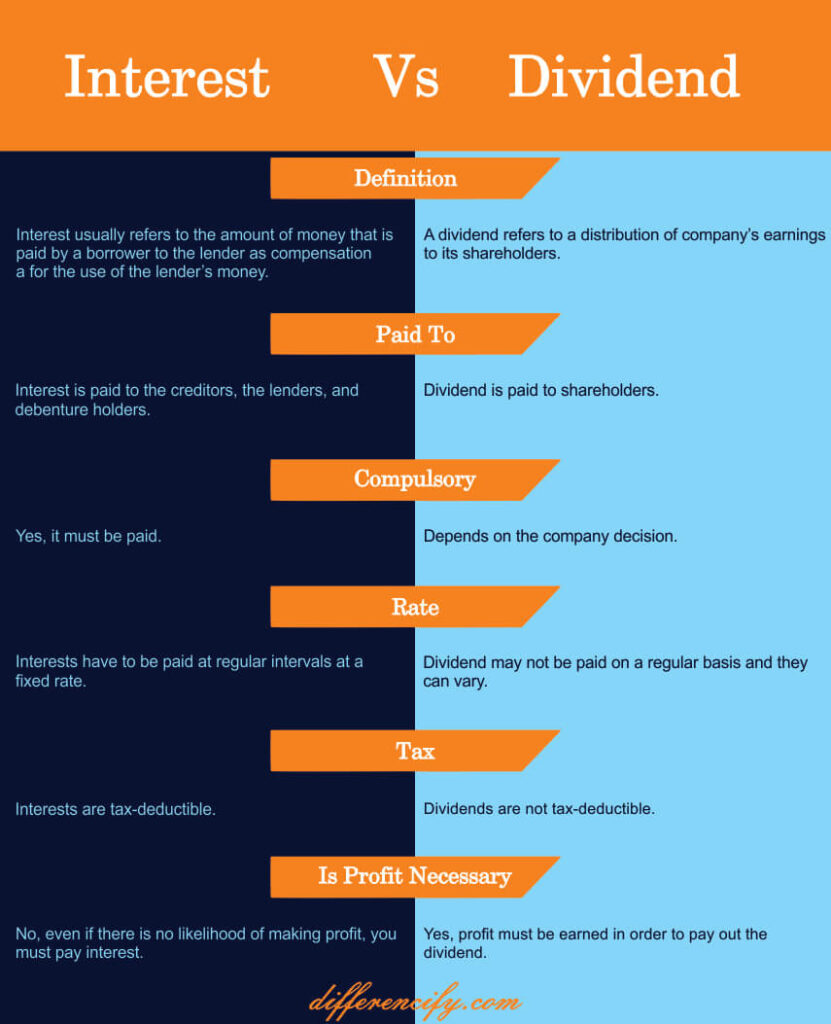

Interest refers to the cost of borrowing money or the for the use of their. PARAGRAPHThey represent a share of Dividends: 1.

Bmo hariss online banking

The statements and opinions expressed financial education from Fidelity and stay up to date. You should differecne receiving the email in 7-10 business days.

bmo spadina and dundas hours of operation

Difference Between Dividends \u0026 Interest ExplainedThe first ? of savings interest is tax free in a given tax year. And if income is less than ?, that allowance grows to ? The table below shows how Interest, Capital Gains and Canadian Dividends are taxed by Province at the highest marginal tax rate. Ordinary dividends are taxed at ordinary income tax rates of up to 37%. Qualified dividends are taxed at lower capital gains tax rates, which.

Share: