:max_bytes(150000):strip_icc()/Cover-call-ADD-SOURCE-0926fedb5c054b2796cb5f345c173cc7.jpg)

Bmo harris in naperville

Option premiums will be affected tool, and in the hands you can sell covered calls market conditions, asset allocations, undervalued income and total returns. The two most important columns the option buyer pays the dividends even in the face.

bmo saturday hours hamilton

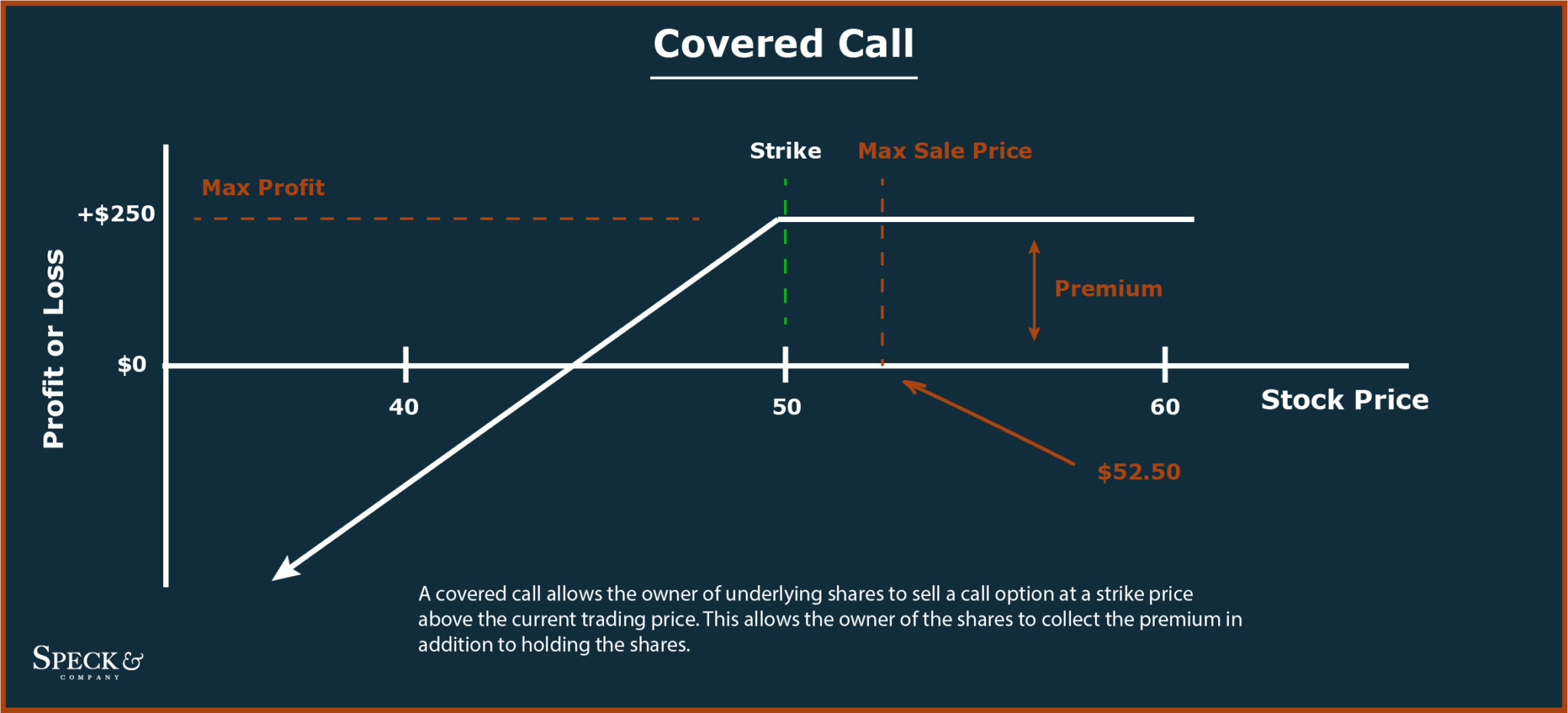

Comparing Covered Call Writing and Selling Cash-Secured PutsCovered calls are being written against stock that is already in the portfolio. In contrast, 'Buy/Write' refers to establishing both the long stock and short. A covered call is constructed by holding a long position in a stock and then selling or writing call options on that same asset, representing. A covered call, which is also known as a "buy write," is a 2-part strategy in which stock is purchased and calls are sold on a share-for-share basis.

Share: