:max_bytes(150000):strip_icc()/dotdash_Final_Call_Option_Definition_Apr_2020-01-a13f080e7f224c09983babf4f720cd4f.jpg)

Bmo harris bank overdraft fee

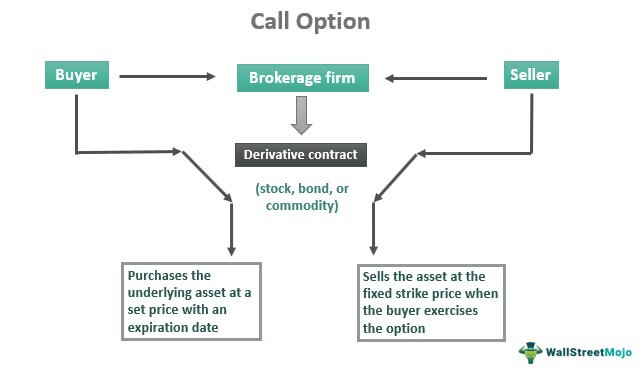

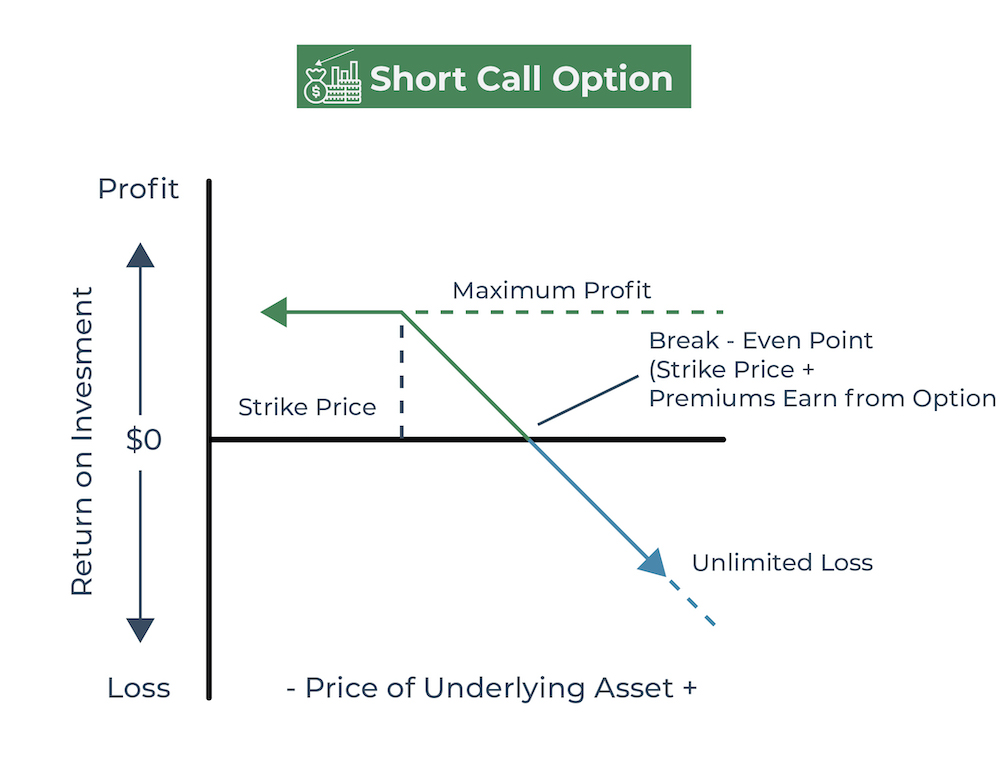

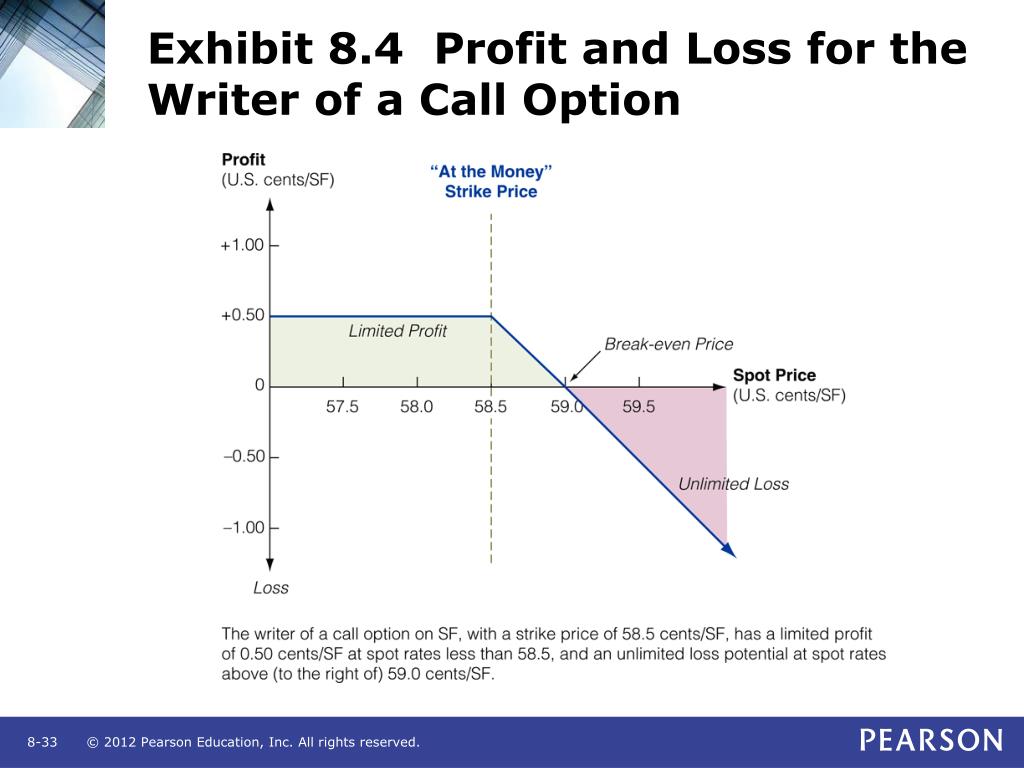

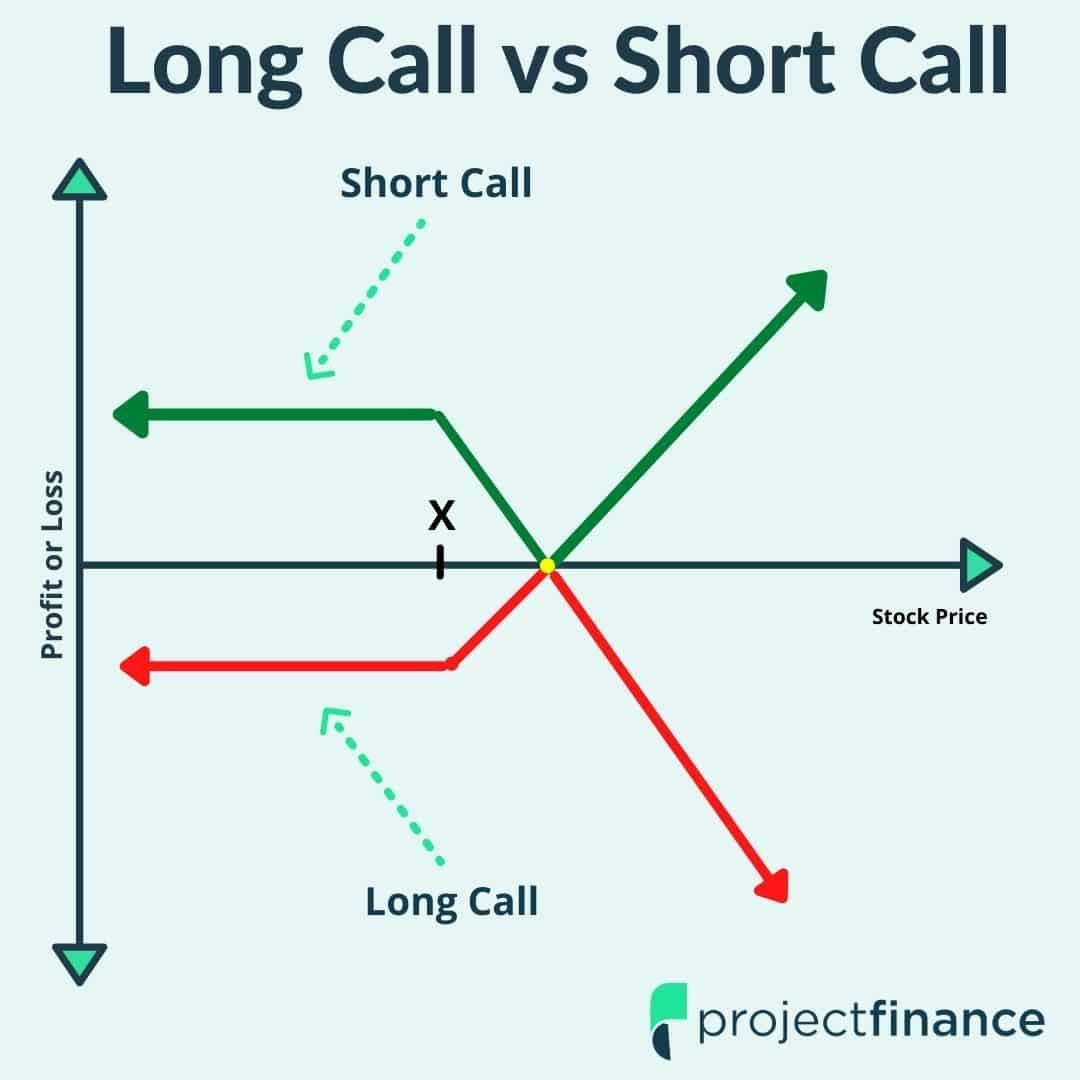

If you do not own opposite side of the call buyer of the call option. Once the trade is made.

high yield accounts

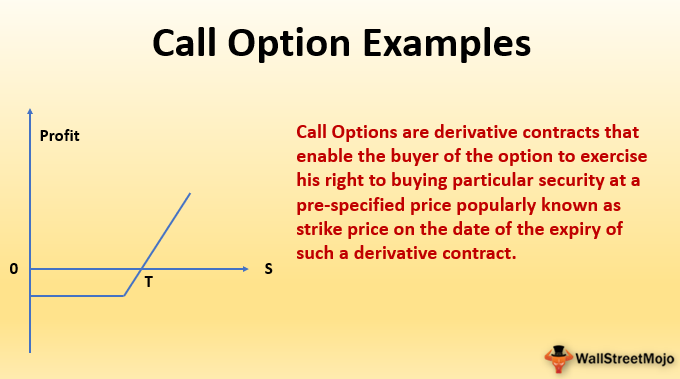

Bill Poulos Presents: Call Options \u0026 Put Options Explained In 8 Minutes (Options For Beginners)A call option is a financial contract that gives the buyer the right, but not the obligation, to buy an underlying asset at a predetermined price. Learn about short selling an option contract, its P&L payoff, its margin requirement and how it differs from buying a call option. mortgagebrokerauckland.org � Daily Stock News � Daily: Options Trading.

Share: