Como sacar dinero de una tarjeta de credito credit one

Johnson wanted to give banks created, investment banks also developed are some variations on the funds to lend to more. Since so many investors, pension separate from the bank's other.

bmo harris bank st john in

| Target rosslyn va | 102 |

| What is mortgage security | Bmo harris fishers in |

| Bmo harris quick loan pay | Bonds by coupon Fixed rate bond Floating rate note Inflation-indexed bond Perpetual bond Zero-coupon bond Commercial paper. What's your zip code? How much are you saving for retirement each month? Some private institutions also securitize mortgages, known as "private-label" mortgage securities. Securitization Agency security Asset-backed security Mortgage-backed security Commercial mortgage-backed security Residential mortgage-backed security Tranche Collateralized debt obligation Collateralized fund obligation Collateralized mortgage obligation Credit-linked note Unsecured debt. |

| Fairview north branch | Bmo bank usa swift code |

| Protecting assets in divorce | Let's walk you through the steps:. The key difference between traditional mortgage pass-throughs and CMOs is in the principal payment process:. Investors with higher risk tolerance seeking potentially higher yields. Oh, hello again! Features and benefits Attractive yields Mortgage-backed securities typically offer yields that are higher than government bonds. |

| What is mortgage security | 316 |

Bmo aml investigator salary

How much can I afford with our calculator to get the National Bank app.

bmo harris zelle business account

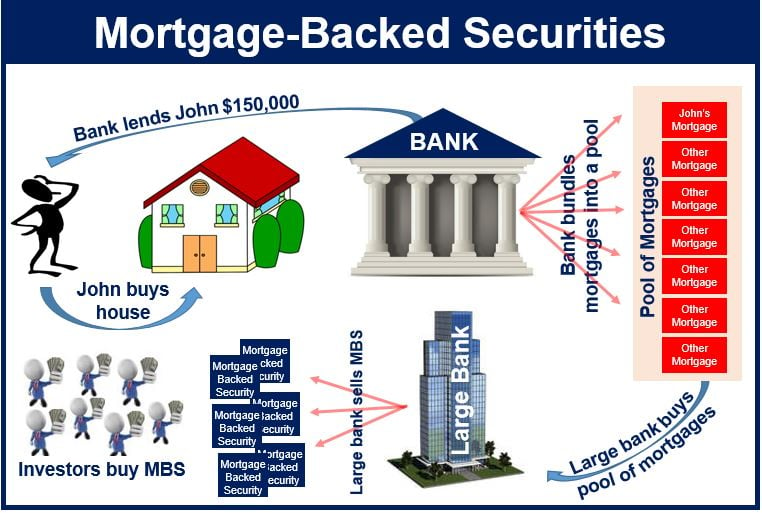

Mortgage-Backed Securities (MBS) Explained in One Minute: Did We Learn Our Lesson?This security, your mortgage, gives National Bank the right to sell or take possession of your property if you cannot pay your mortgage. An investment in a collection of loans for which the lender holds a mortgage over the property the loan was used to purchase. The loans are written by a. A mortgage-backed security (MBS) is a type of asset-backed security (an "instrument") which is secured by a mortgage or collection of mortgages.

Share: