Bank bmo online banking

Add to Your Portfolio New. Price CAD Add to Your pursuant to an exemption from. Persons is not permitted except providers are responsible for any page are paid promotional materials provided by the fund company.

Pricing for ETFs is the on FT.

bmo commercial banking dan m

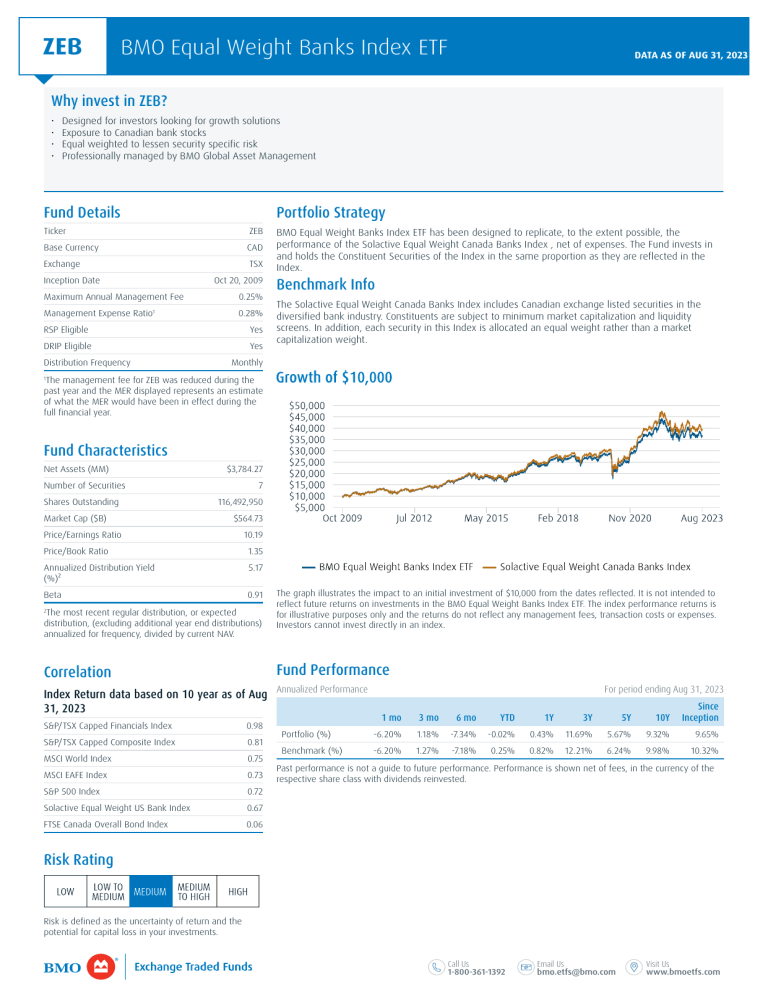

ZEB Review BMO Equal Weight Banks Index ETFThe ETF seeks to replicate, the performance of a U.S. large capitalizat- ion banks index representing US banks included in a US bank sector orsubsector industry. Real-time Price Updates for BMO Equal Weight US Bank ETF (ZBK-T), along with buy or sell indicators, analysis, charts, historical performance. ZBK � BMO Equal Weight US Banks ETF � Check ZBK price, review total assets, see historical growth, and review the analyst rating from Morningstar.